Process for online Additional borrowing digital services

How to get a quote and illustration (KFI):

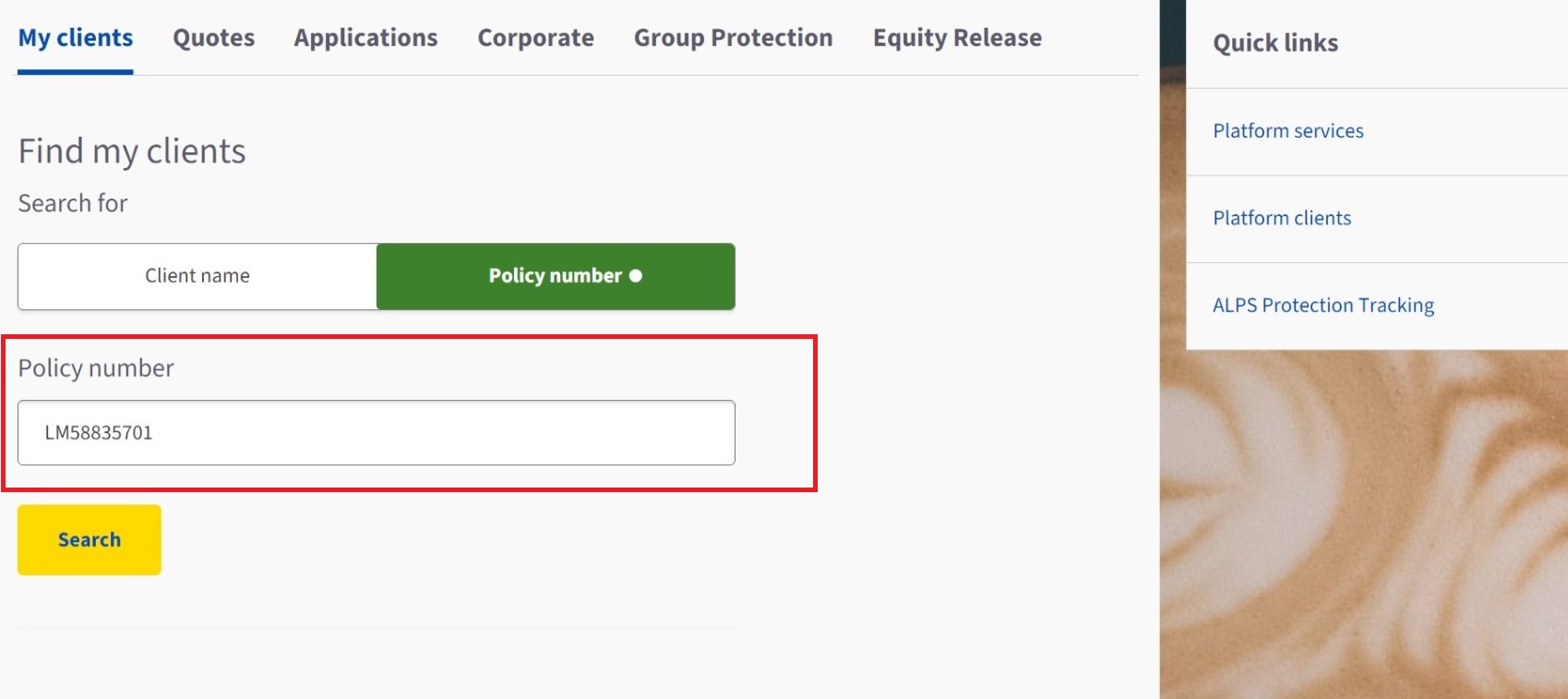

1. Login to the Aviva Adviser website you will land on My clients tab.

Search for your client’s lifetime mortgage account either by client name or policy number.

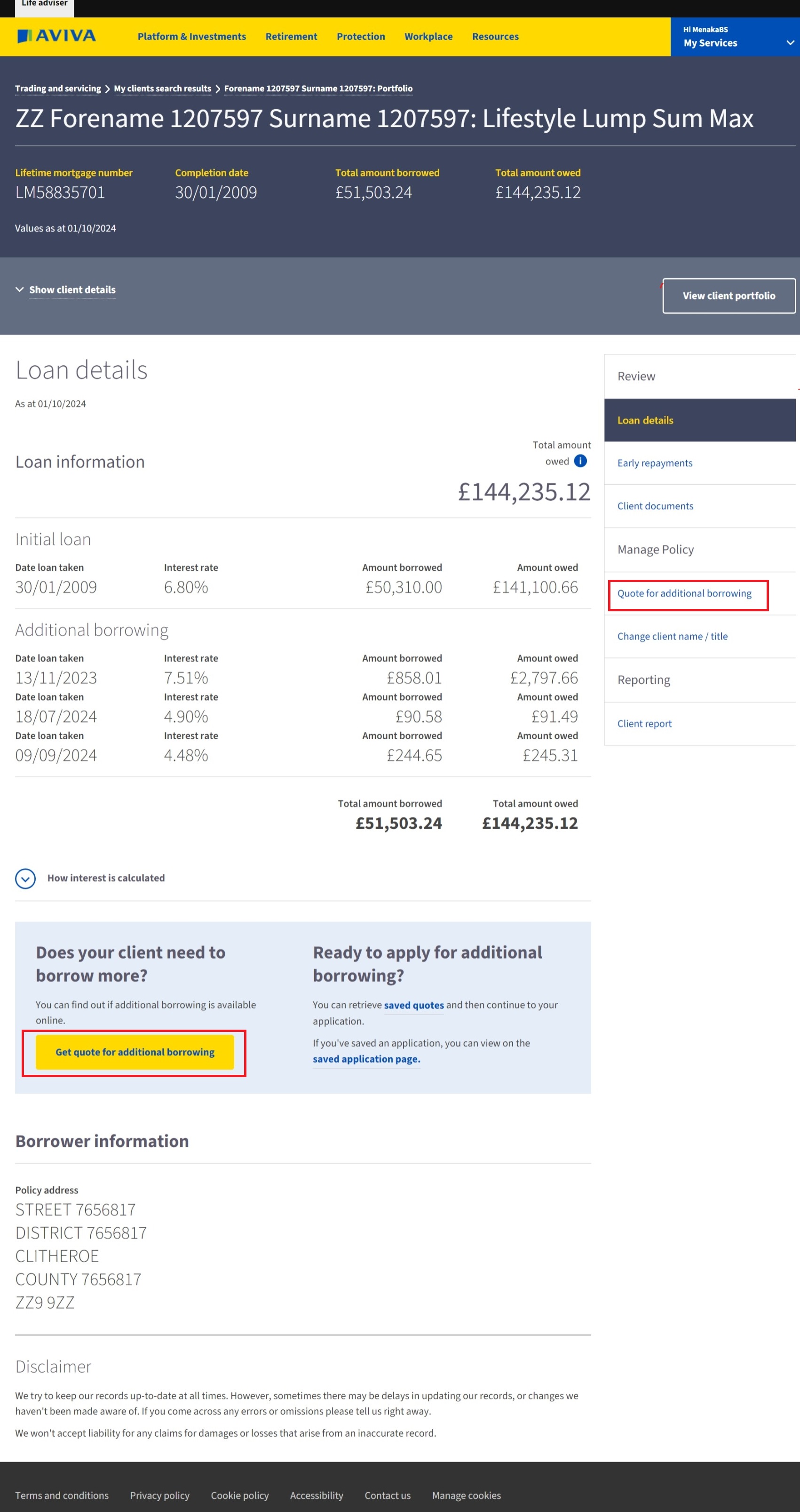

2. Click on Quote for additional borrowing link either in the RH navigation or the yellow button below the clients lifetime mortgage account details.

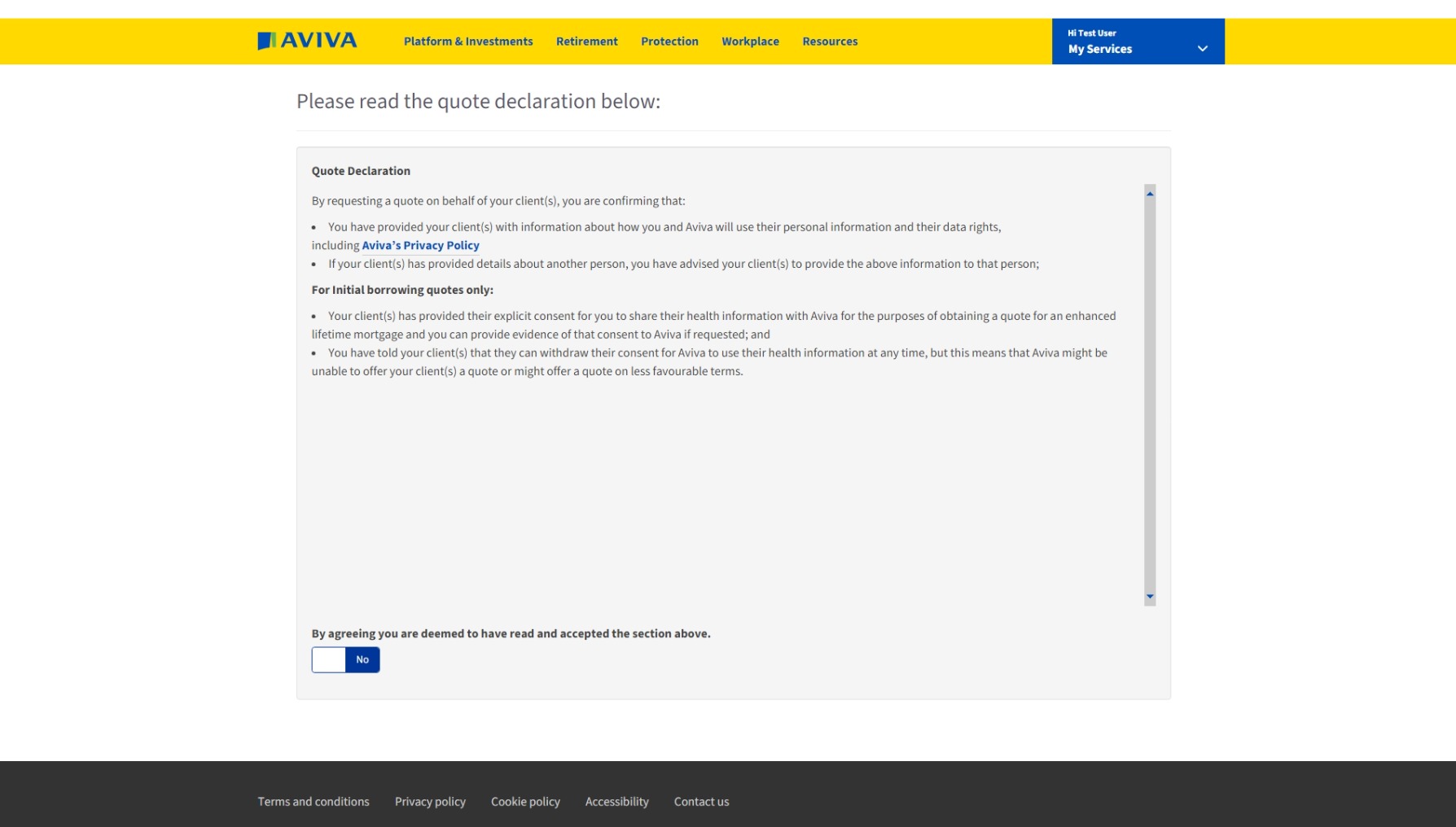

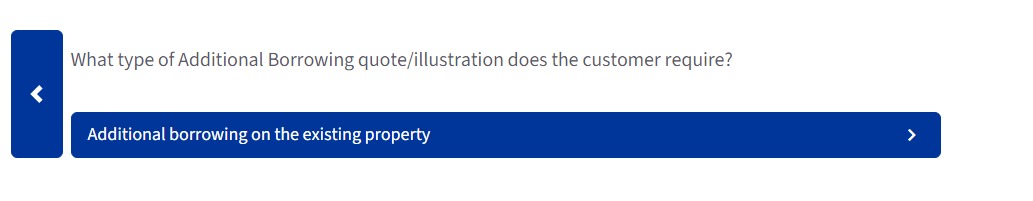

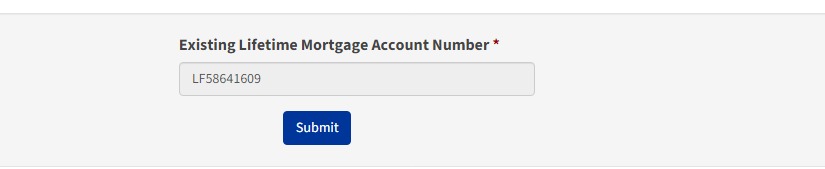

3. You need to attest to the quote declaration before you proceed and answer a set of 3 questions about the type of quote. Then submit the pre populated lifetime mortgage account number.

4. Lifetime mortgage account number and submit.

All of your client’s details will now pre populate the quote input fields where possible. Check the details are correct and complete the blank field for the estimated property value.

NOTE: If client details or property information have changed and need updating you will not be able to continue. Email ERAB@aviva.com with details of what needs changing. As soon as you receive an email confirmation back to confirm the details have been changed you will be able to continue with the online quote.

5. After checking and entering your clients personal and property details you will see whether further borrowing is available.

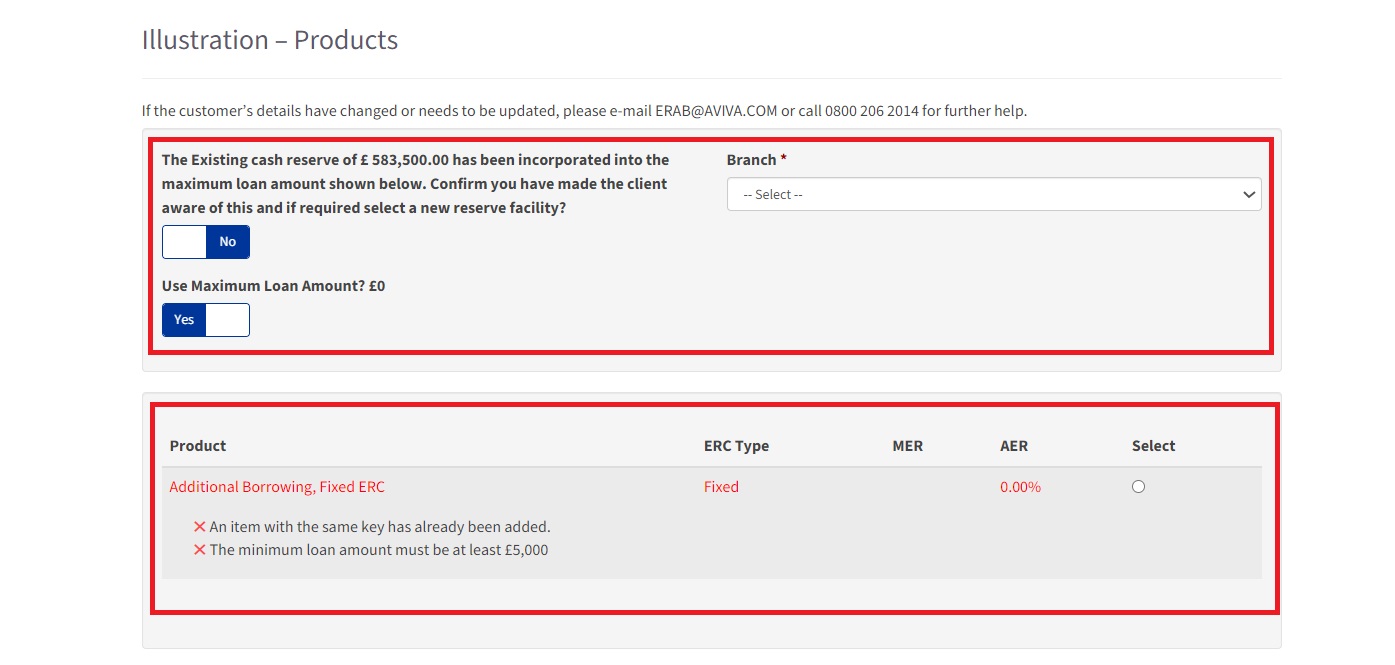

If no further borrowing is available the maximum loan amount will show as £0 and a product will not be available to select.

You can contact equityreleasefapresales@aviva.com if you need a no funds available email confirmation.

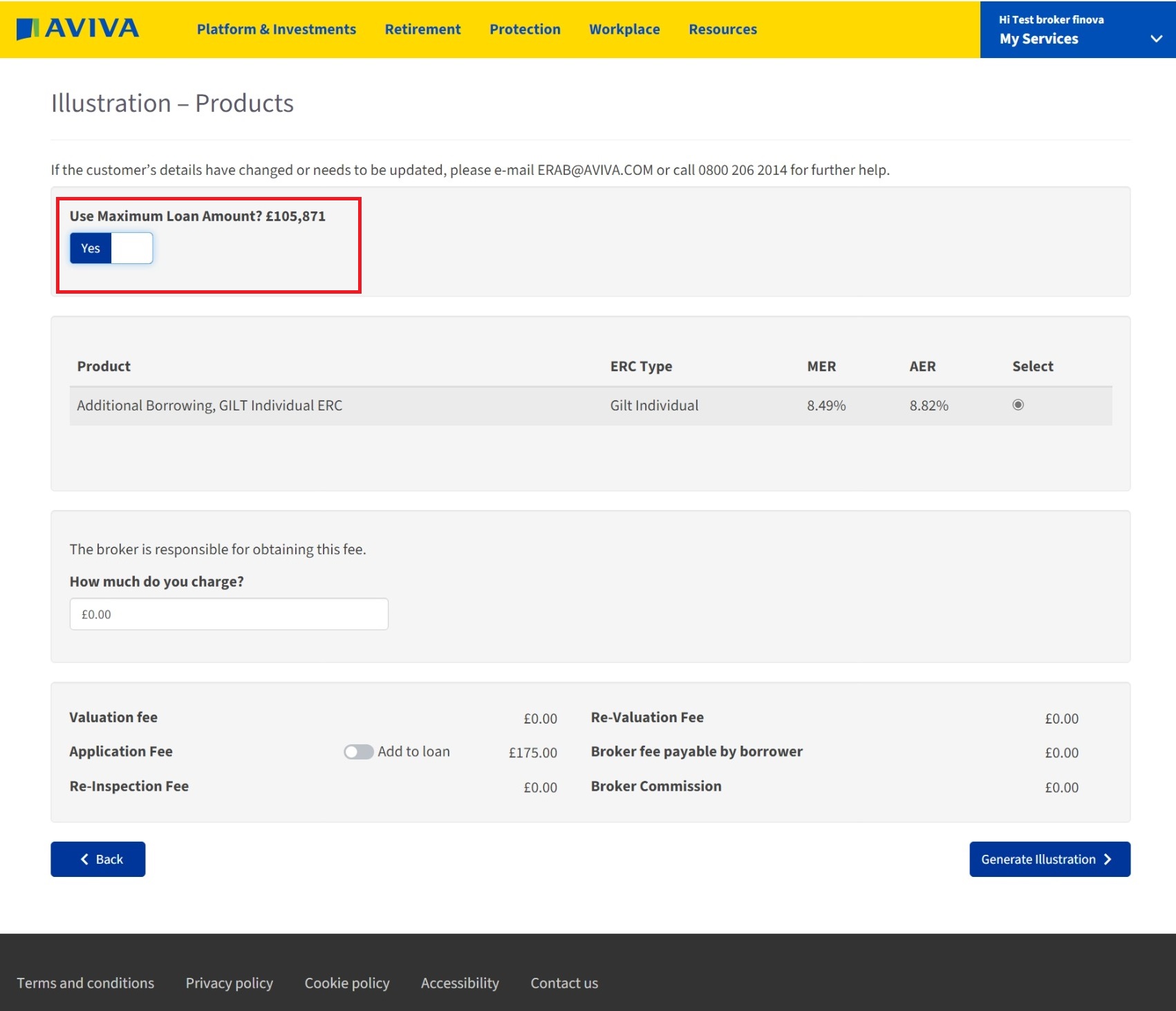

If further borrowing is available, you will see the maximum loan amount available and can continue to get a quote by inputting the quote data fields, for example continuing with a maximum loan quote or choosing a specific loan amount by sliding the maximum loan amount from Yes to No.

Do not click the slider 'add to loan' next to application fee. The slider should be disabled. The application fee is included in the loan amount so will be deducted from the amount paid to the client. You can adjust for the £175 application fee by amending the loan amount requested accordingly.

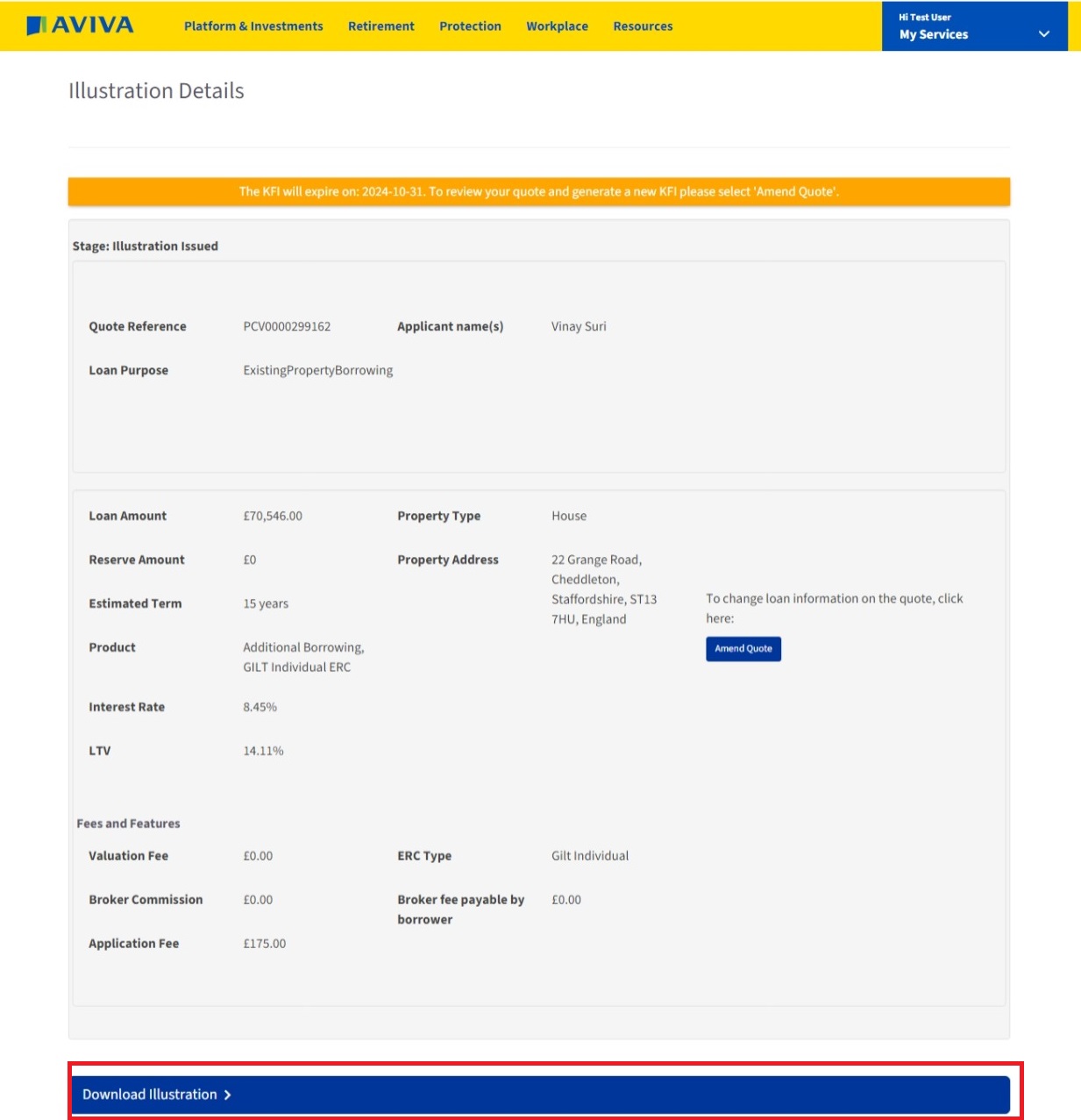

6. After inputting quote details you can generate and download an illustration (KFI).

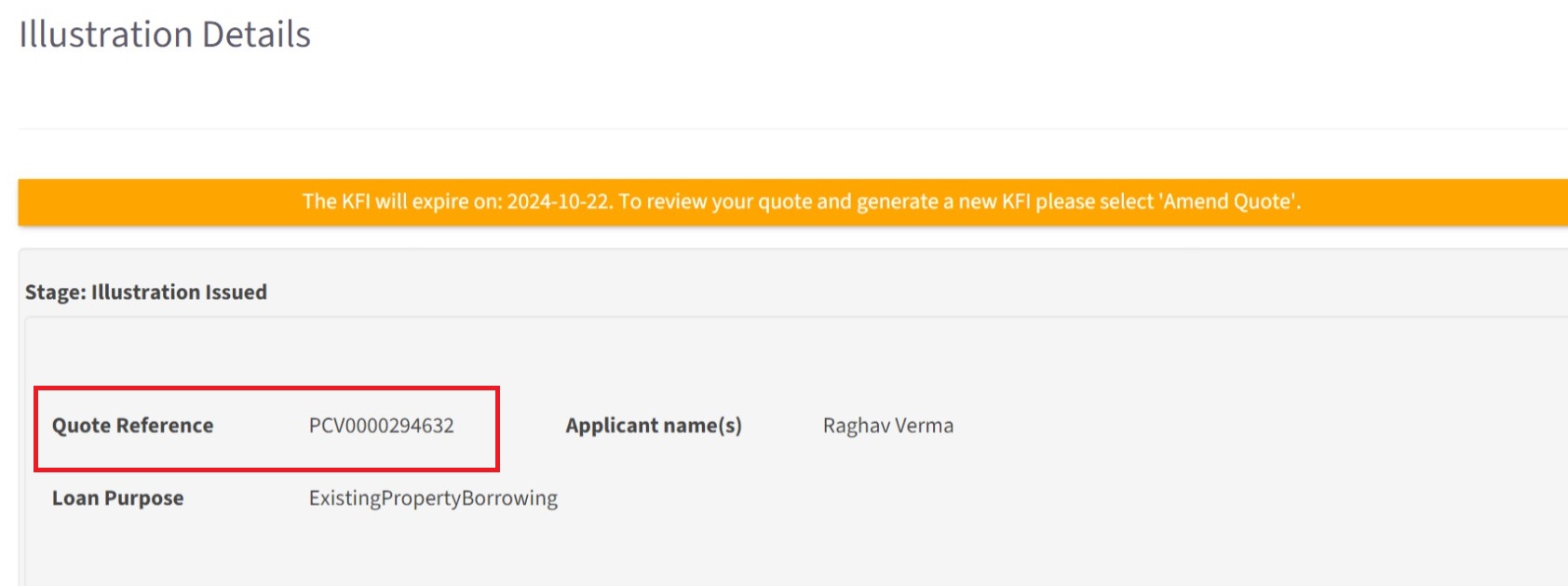

7. All Additional borrowing quotes will generate a quote reference with a prefix 'PCV'. This PCV reference shows in the footer of the KFI. The PCV reference number is needed for when you are ready to apply. Especially important if multiple quotes have been created as each quote has a unique reference number. You will also need the PCV reference number to track the application. The offer document which we send to the client will show the Lifetime mortgage account number.

How to apply for additional borrowing:

1. Login to the adviser website.

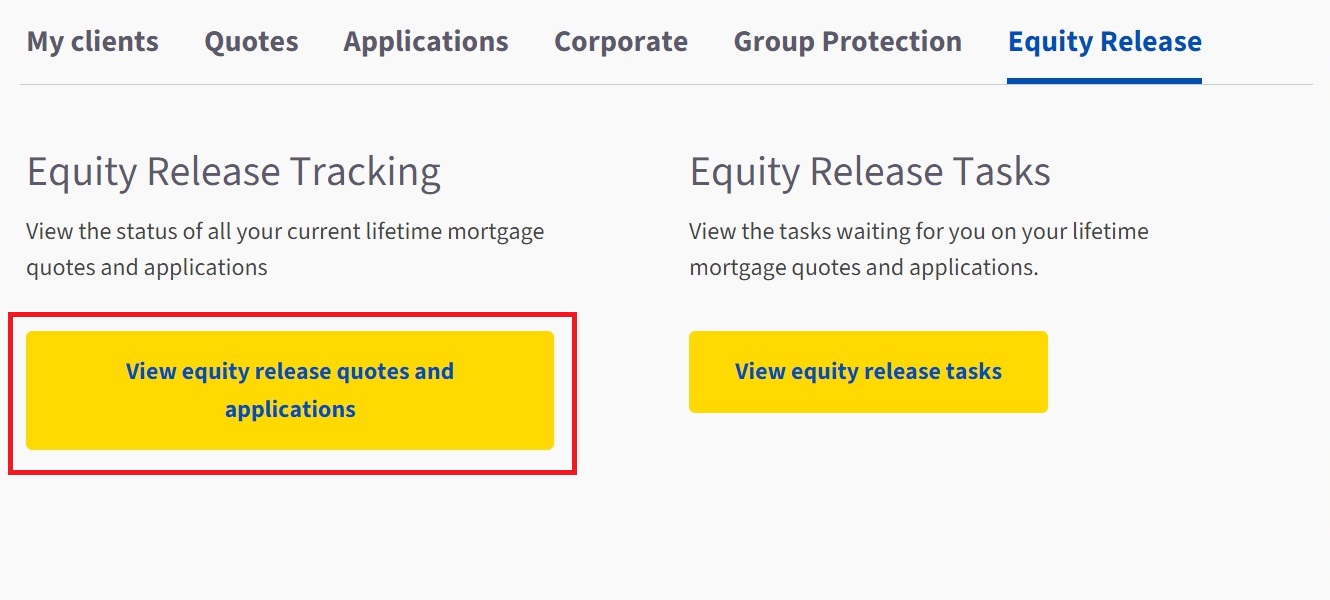

2. Click on Equity Release tab.

3. Click on Equity Release Tracking ‘View equity release quotes and applications’.

4. Search for the PCV quote reference number you wish to apply on and when found, click on it.

5. Click on ‘continue to full mortgage application’ button.

6. The online application follows the same screens you will be familiar with for initial borrowing – the difference being that the solicitor details screen has been replaced with bank details.

If you need to familiarise yourself with the initial borrowing online application watch this quick video demo.

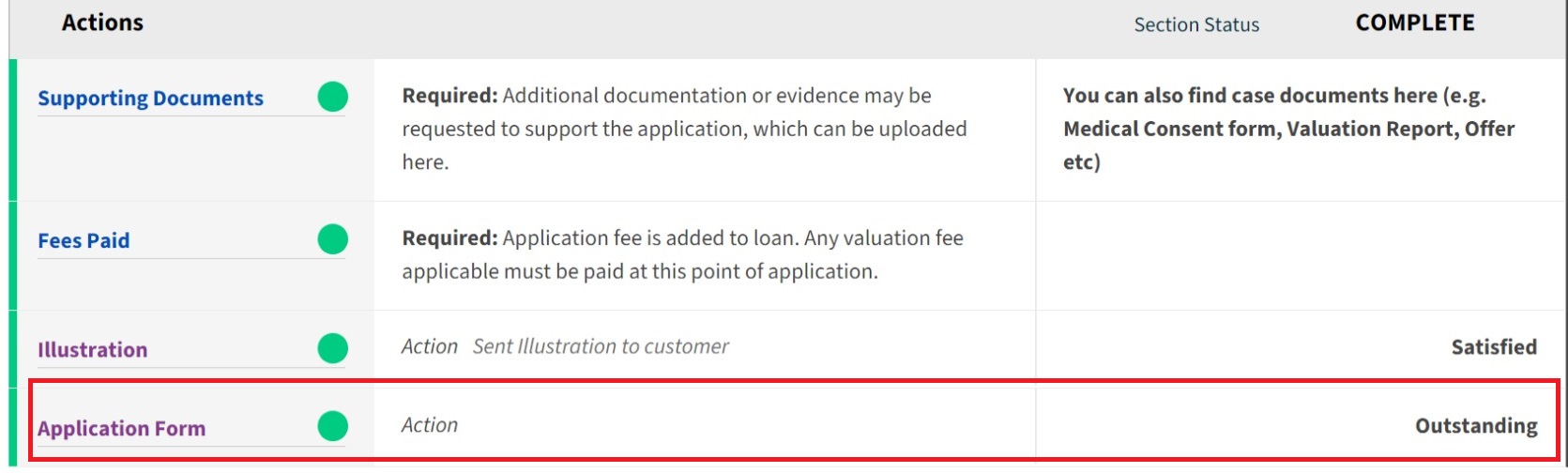

You can also download a copy of the online application by selecting Application form in the application dashboard. You can get to the application dashboard by logging into the Adviser website, click on Equity Release then View equity release quotes and applications. Find your clients additional borrowing application by searching either the client name or PCV reference number. Click on the case and you will see the application dashboard.

Tasks

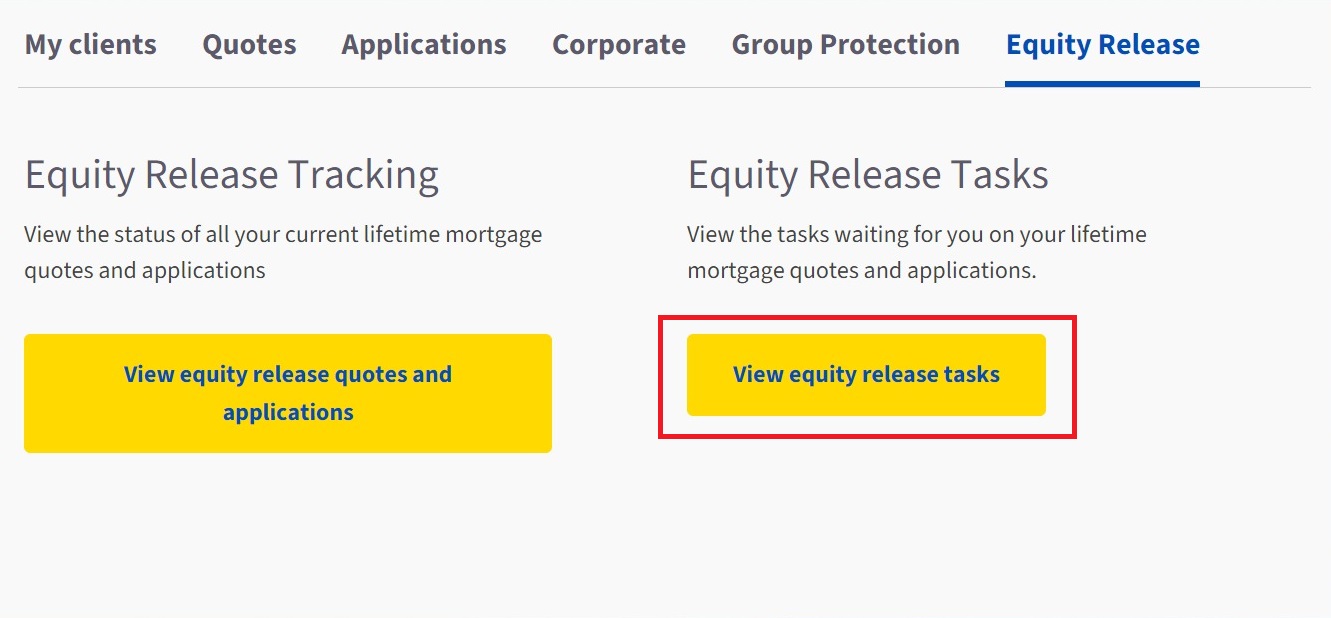

If additional information is required after you have submitted the application a task will be generated. You will be notified by email when a task is generated. You can view and manage all tasks by logging into the adviser website, click on Equity Release and click on view equity release tasks.

You could see initial borrowing and additional borrowing tasks here. Initial borrowing tasks have an 'ER' prefix reference and additional borrowing tasks have a 'PCV' prefix to the reference number.

Tracking applications through to completion

Once you have submitted the application you can track the progress of the application in the same way that you do for initial borrowing application. More information is available here.

Remember, initial borrowing applications have an 'ER' prefix and additional borrowing applications have a 'PCV' prefix.