SMF - May 2025 update

Top 3 investment themes – May 2025

In May, global attention remained firmly on the United States. Following the dramatic market correction triggered by Trump’s ‘Liberation Day’ speech on 2 April – during which the S&P 500 fell by more than 15% amid fears of a US recession – markets staged an extraordinary recovery in May.

1. Tariff uncertainty persists despite major breakthrough

Investor concerns about an imminent US – and potentially global – recession began to ease in May, following a series of conciliatory moves and successful trade negotiations. Early in the month, the UK reached a preliminary deal with Trump, raising hopes for further progress. The most notable development came on 12 May, when the US and China announced an agreement to significantly reduce tariffs following talks in Geneva. This marked a major step towards de-escalation and led to a sharp rally in global equities. However, uncertainty remains. Trump’s 90-day pause on tariffs is due to end in early July, and a fresh escalation occurred at the end of May with his announcement of a potential doubling of levies on steel and aluminium imports to 50%. In this context, short- to medium-term market volatility is likely to continue.

2. Resilient fundamentals despite economic contraction

US GDP shrank by 0.2% in Q1 2025, ending an 11-quarter growth streak and contrasting sharply with the 2.4% expansion seen in Q4 2024. The contraction was largely attributed to a surge in imports ahead of the early April tariff announcement. Despite this setback, key indicators such as growth, income, and employment remained robust. Most notably, the US economy added 177,000 jobs in April – well above the 135,000 forecast by economists polled by Bloomberg. Corporate earnings also exceeded expectations, with strong results helping to buoy sentiment despite broader concerns. Given ongoing fears about the impact of tariffs on supply chains – particularly within the technology sector – results were closely watched and generally well received. Big tech led the way, with Microsoft, Meta Platforms, and Nvidia all beating expectations. Nvidia’s data centre revenue rose an impressive 73% year-on-year. The energy, banking, healthcare, and utilities sectors also performed strongly, helping maintain investor confidence.

3. A ‘big, beautiful budget’ (deficit)

Government debt continues to rise and is becoming increasingly expensive to service in the higher interest rate environment that has persisted since 2022. Trump’s unveiling of a ‘big, beautiful budget’ at the end of May came against the backdrop of record deficits worldwide, which has dominated bond markets, overshadowing a softer inflation print in the US. His proposed 2026 budget outlined deep cuts to non-defence spending, a boost in defence funding, and reduced support for climate and sustainability programmes. In the US, net interest payments on government debt are expected to soar in the coming decades – a trend mirrored across other developed economies with increased spending plans expected within Europe too. This has undermined confidence in the safe haven status of US Treasuries in particular. In response, Moody’s downgraded the US credit rating from AAA to Aa1 in May.

May 2025 Market performance (GBP terms)

.jpg)

Past performance is not a reliable indicator for future performance.

Source: Morningstar as at 31 May 2025. Equity returns are in GBP, commodity in USD and fixed income is GBP hedged.

How did SMF perform?

Growth assets

After a volatile start to the year, May saw a notable recovery for risk assets driven by positive macro data and progress in US trade negotiations. The positive shift in investor sentiment led to a rally by the S&P 500, as well as UK and EM equities as the UK and China settled on better trading terms with the US. Despite some new tariff uncertainty towards the end of May, all key equity regions delivered positive performance overall for the month which was reflected in the portfolios. In terms of active positioning, whilst our USD-Yen position detracted, our tactical overweight positions in European equities and Emerging Market equities (vs an underweight in US) were additive to performance.

Defensive assets

Global fixed income, notably sovereign bonds, struggled in May as investors’ fiscal concerns resurfaced. This was triggered by Moody downgrading US’ credit rating, which was then followed by President Trump’s tax bill announcement. Given this, long-end US bond yields trended beyond the key 5% milestone and delivered their first negative monthly performance this year. Yields, and hence bond prices, also came under pressure in the UK following a higher-than-expected inflation reading. With global yields moving higher, and bond prices lower, our global fixed income holdings generally posted negative performance over the month. For MAF Plus, our tactical overweight duration positions in UK Gilts, US Treasuries & European bonds detracted over the month.

Uncorrelated assets

Uncorrelated assets helped to offset some of the fixed income weakness over May. Whilst AIMS slightly detracted, our property holding delivered positive returns for the Uncorrelated sleeve.

Key active management themes in May 2025

1. Added to overall equity positions

- We opened an overweight position in Emerging Market equities vs an underweight in US equities (relative value trade), given the continued investor caution towards the US market. Hence, we also closed our outright overweight position within US equities mid-month.

- Within the UK, we opened an overweight position in Russell 150 vs an underweight in FTSE 100. The UK’s progress towards trade deals with both the EU and US could lead to upward growth expectations which should benefit UK mid-cap companies vs the broader market.

- Lastly, we opened an overweight position within European equities as positive sentiment, giving the anticipation of fiscal plans, continues to drive momentum within the region.

2. Reduced US dollar exposure

- Have further reduced our dollar exposure within the portfolios via FX forwards, given continued pressure on the currency given Trump’s administration’s policy decisions.

Past performance is not a reliable indicator of future performance

Source: Morningstar as at 30th April 2025. Performance of the funds are net of fee.

The launch date of SMF (pension) was 11/12/2017, SMF (bond) 18/02/2019, SMF II (pension) 30/06/2021 and SMF II (bond) 30/06/2021.

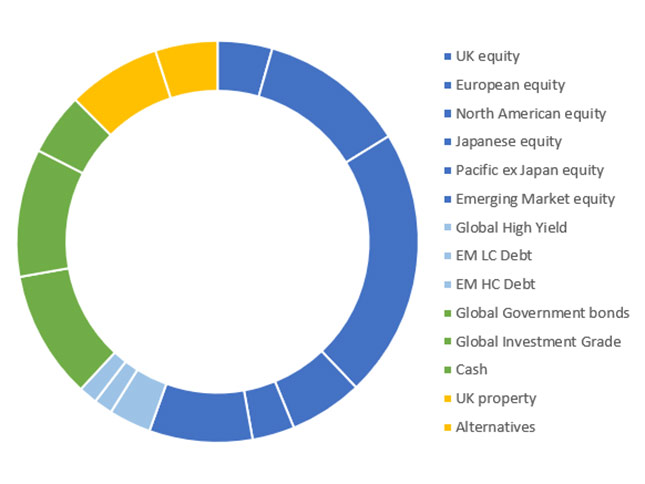

SMF Strategic Asset Allocation

Source: Aviva Investors. This diagram is for illustrative purposes only, asset allocations are subject to change. The reference fund is SMF, based on its strategic asset allocation as at 30 June 2024.

Top 10 Equity holdings

| Equity | Holding |

| Microsoft | 1.3% |

| Apple | 1.3% |

| Nvidia | 1.2% |

| TSMC | 0.8% |

| Amazon | 0.8% |

| Alphabet | 0.7% |

| Meta | 0.5% |

| Tencent Holdings | 0.5% |

| SAP | 0.5% |

| ASML | 0.4% |

Source: Aladdin, as at 8 May 2025. The reference fund is SMF. The companies mentioned are for illustrative purposes only, not intended to be an investment recommendation.

SMF & SMF 2 Fund Price Adjustments (FPA)

There were no fund price adjustments in May 2025.

Market outlook and positioning: what do we believe happens next?

Over the last month, positive progress on trade deal negotiations has allowed for a cautiously positive outlook for equities, despite potential challenges to the growth outlook. Given this, we are now overweight Emerging Market, European and UK equities to provide diversification within our equity allocation. We expect Emerging Markets equities to outperform US equities whilst in Europe, equities should continue to benefit from positive investor sentiment about fiscal plans. In the UK, we have focused our exposure on mid-cap companies which are more domestically focused and should benefit more from improved growth prospects for the UK economy.

Regarding our fixed-income allocation, we maintain an overweight positions in US Treasuries, German Bonds and Gilts, with the latter also vs an underweight in French OATs. This reflects our view that, in the case of a growth slowdown, global fixed income should be better positioned to protect portfolios. Within the US, we have also focused our duration exposure in shorter-term bonds which are less exposed to long-term bond sell-offs driven by fiscal concerns. For France, we have opened an underweight position as we see specific fiscal risks where higher increases in spending, compared to the rest of Europe, are likely to put downwards pressure on bond prices.

Any companies, or markets, mentioned are for illustrative purposes only, not intended to be an investment recommendation.

Key risks

- Investment not guaranteed: The value of an investment is not guaranteed and can go down as well as up. You could get back less than you’ve paid in.

- Specialist funds : Some funds invest only in a specific or limited range of sectors. This will be set out in the fund’s aim. These funds may be riskier than funds that invest across a broader range of sectors.

- Suspend trading : Fund managers are often able to stop any trading in their funds in certain circumstances for as long as necessary. When this happens, cashing in or switching your investment in the fund will be delayed. You may not be able to access your money during this period.

- Derivatives: Derivatives are financial contracts whose value is based on the prices of other assets. Most funds can invest partly in derivatives so that the fund can be managed more efficiently or to reduce risk, but there’s a risk that the company that issues the derivative may default on its commitments, which could lead to losses. Some funds also use derivatives to increase potential returns – this is known as ‘speculation’ – and an additional risk warning applies to those funds.

- Foreign exchange risk: When a fund invests substantially in overseas assets, its value will go up and down in line with movements in exchange rates as well as the changes in value of the fund’s investments.

- Emerging Markets: Where a fund invests substantially in emerging markets, its value is more likely to move up and down by large amounts and more frequently than a fund that invests in developed markets. Emerging markets may not be as strictly regulated, and investments may be harder to buy and sell than in developed markets. Emerging markets may also be politically unstable which can make these funds riskier.

- Smaller Companies: Where a fund invests in substantially the shares of smaller companies, it’s more likely to move up and down by large amounts and more frequently than a fund that invests in the shares of larger companies. The shares can also be more difficult to buy and sell, so smaller-companies funds can be riskier.

- Fixed Interest: Where a fund invests substantially in fixed-interest assets, such as corporate or government bonds, changes in interest rates or inflation can contribute to the value of the fund going up or down. For example, if interest rates rise, the fund’s value is likely to fall.

- Derivatives: Some funds also invest in derivatives as part of their investment strategy, not just for managing the fund more efficiently. Under certain circumstances, derivatives can cause large movements up or down in the value of the fund, making it riskier compared with funds that only invest in, for example, company shares. There’s also a risk that the company that issues the derivative may default on its commitments, which could lead to losses.

- Cash/Money Market funds : These are different to cash deposit accounts, such as those held with high-street banks, and their value can fall. Also, when interest rates are low, the fund’s charges could be higher than the return from the investment, so you could get back less than you’ve paid in.

- Property Funds: When a fund invests substantially in property funds, property shares or directly in property, you should bear in mind that: · Property isn’t always easy to sell, so at times the fund may not be able to cash-in or switch part or all of its holdings. You may not be able to access your money during this time. Property valuations are made by independent valuers, but effectively they remain a matter of judgement and opinion. Property transaction costs are high due to legal costs, valuation costs and stamp duty, all of which affect the value of a fund.

- High Yield Bonds: These are issued by companies and governments that have a lower credit rating. When a fund invests substantially in high yield bonds, there’s a higher risk that the bond issuer might not be able to pay interest or return the capital that was invested. The value of these bonds is also more greatly affected by economic conditions and interest rate movements. There may be times when it’s not easy to buy or sell these bonds, so cashing-in or switching your investment in the fund may be delayed. You may not be able to access your money during this period.

- Reinsured Funds: Where a fund invests in a fund that’s operated by another insurance company, you could lose some or all of the value of your investment in the fund if the other insurance company became insolvent.

- Long-Term Asset Funds: The fund invests partly in one or more long-term asset funds (LTAFs), giving access to sectors such as infrastructure, venture capital, private equity and debt investments. LTAFs add diversity to the fund, but it takes longer to move money out of them than from many types of asset. This could mean that in exceptional circumstances cashing-in or switching your investment in the fund may need to be delayed. To reduce this risk, we set strict limits on how much of the fund can be invested in LTAFs and monitor this closely.

Important information

THIS IS A MARKETING COMMUNICATION

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited (AIGSL). Unless stated otherwise any views and opinions are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. Information contained herein has been obtained from sources believed to be reliable but, has not been independently verified by Aviva Investors and is not guaranteed to be accurate. Past performance is not a guide to the future. The value of an investment and any income from it may go down as well as up and the investor may not get back the original amount invested. Nothing in this material, including any references to specific securities, assets classes and financial markets is intended to or should be construed as advice or recommendations of any nature. This material is not a recommendation to sell or purchase any investment. In the UK this is issued by Aviva Investors Global Services Limited. Registered in England and Wales No. 1151805. Registered Office: 80 Fenchurch Street, London, EC3M 4AE. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119178.