Smooth Managed Funds Now Available on the New Onshore Bond

Alan Thompson, Investment Development Manager

We’re pleased to announce the launch of Aviva’s Smooth Managed Funds on our new Onshore Bond, now available via the Aviva Platform.

This significant development brings together the proven benefits of our smoothing investment approach with the tax efficiency and planning flexibility of a modern onshore bond.

In volatile markets, investors frequently face uncertainty that can undermine their long-term financial goals.

Our Smooth Managed Funds are designed to offer a steadier investment journey, helping clients remain invested with confidence, now wrapped in a product that supports everything from tax-efficient withdrawals to estate planning.

Why Choose the Aviva Onshore Bond + Smooth Managed Funds

This launch gives advisers a flexible new way to support clients’ medium to long-term financial plans, combining the potential for smoother returns through the Smooth Managed Funds with efficient tax treatment.

- Smoother Investment Experience

Our forward-looking smoothing process helps reduce some of the impacts of short-term market fluctuations, enabling clients to stay invested with greater confidence during periods of volatility.

- Flexible Tax Planning

With the Onshore Bond structure, clients benefit from an element of tax deferred growth, the ability to assign segments, and access to top-slicing relief for withdrawals, making it ideal for clients managing income in retirement or planning legacy gifts.

- 101% Death Benefit + Trust Compatibility

Built in death benefit protection and access to Aviva trust solutions make this bond a strong option for clients considering inheritance tax planning.

- Two Smooth Fund Options – Tailored to Risk Appetite

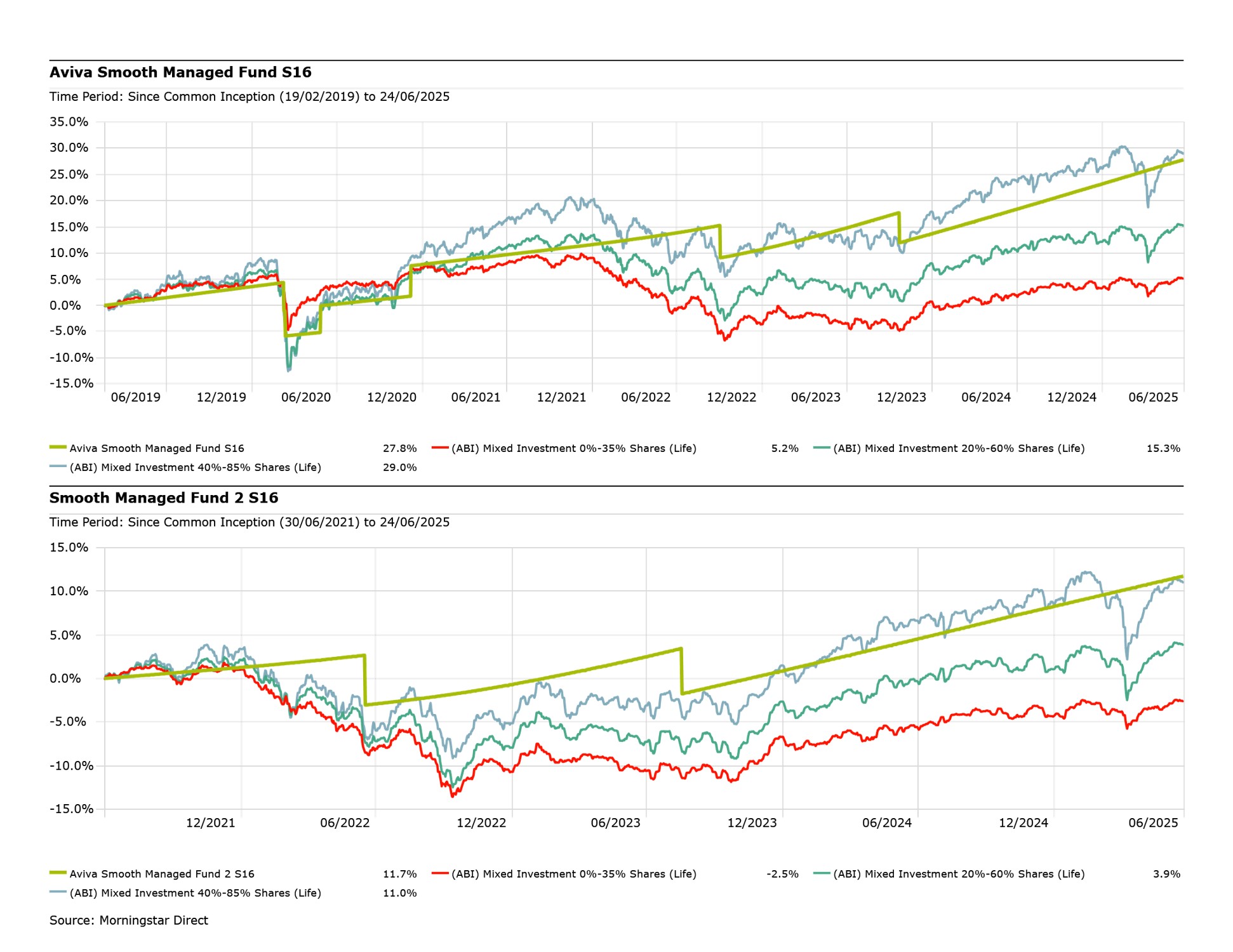

Smooth Managed Fund (ISIN: GB00BSDY0Y86) (Risk-rated 5 - Defaqto & Dynamic Planner): Designed for clients seeking long-term growth with reduced volatility.

Smooth Managed Fund 2 (ISIN: GB00BSDY0Z93) (Risk-rated 4 - Defaqto & Dynamic Planner): A more cautious option offering the same smoothing benefits with a lower risk profile.

How the Smoothing Works

At the heart of the solution is our forward-looking smoothing mechanism, designed to help cushion clients from daily market noise.

- Smooth Growth Rate – Currently linked to the Bank of England base rate, applied daily to support steady growth.

- 6.5% smoothing corridor – Acts as a buffer against short-term market swings, reducing the likelihood of emotionally driven investment decisions.

- Volatility management – Helps manage sequence risk and volatility drag, especially important for income withdrawals from the bond.

Support Your Clients with a Smoother, More Versatile Bond Solution

The new Onshore Bond on the Aviva Platform offers advisers a powerful planning tool, now enhanced by the consistent, long-term approach of our Smooth Managed Fund range.

Whether your clients are seeking tax-efficient growth potential, drawing retirement income, or planning for the next generation, this combination brings together investment stability and product flexibility in one compelling solution.

"The addition of a fully integrated Onshore Bond to the Adviser platform is a critical solution to support effective tax planning for clients. Now, with the added benefit of the Smooth Funds within the Onshore Bond, advisers can take advantage of both the tax benefits and smoothed returns, giving clients greater tax and investment comfort. Aviva are committed to delivering solutions that offer great value and meet the adviser, and client needs. We'll continue listening to feedback and delivering updates and exciting additions to our offer."

Al Ward - Head of Adviser Platform

Please note that:

The value of investments can go down as well as up, and investors may not get back what they put in.

Tax treatment depends on the individual circumstances of each client and tax rules may be subject to change in the future.

A large fall in the market can lead to a price adjustment being applied to the Smooth Managed Funds which could cause a sharp drop in the funds value.

To help you understand more about the Onshore Bond, you can find further information in our Onshore Bond at a glance document.

You can also find answers to your frequently asked questions here.

For further queries please get in touch with your usual Aviva contact.