Understanding Chargeable Event Gains in Investment Bonds

When it comes to investment bond taxation, understanding chargeable event gains is crucial. Chargeable events can significantly impact an investor's tax liabilities and overall returns. This article delves into the key occasions that trigger chargeable events, and how to calculate chargeable event gains.

First lets quickly recap the differences in the taxation of Onshore and Offshore Bond.

Onshore Bonds

With onshore bonds, the underlying funds are subject to tax deductions. This tax is deemed to be at the basic rate of 20%. Importantly, this tax cannot be reclaimed, regardless of the individual's personal tax position. For instance, even if an investor is a non-taxpayer, they would still be unable to reclaim the 20% tax deemed to have been paid within the fund.

Offshore Bonds

In contrast, offshore bonds operate under a different tax regime. The underlying funds in offshore bonds are not deemed to have suffered any tax. This is often referred to as the fund benefiting from "gross roll-up." Essentially, this means that the investment grows without any immediate tax deductions, potentially leading to higher returns over time.

Choosing Between Onshore and Offshore Bonds

Deciding whether to invest in a UK (onshore) bond or an offshore bond depends on various factors, including the investor's circumstances, investment goals, and tax status. For example, whether the investor is a non-taxpayer or a lower-rate taxpayer can influence the decision. Additionally, considerations such as the investment term and the likely final beneficiary play a crucial role in this decision-making process.

Chargeable Events in Investment Bonds

A chargeable event is a key concept in investment bond taxation. Various occasions can trigger a chargeable event, and understanding these can help investors manage their tax liabilities effectively.

Multiple Lives Assured

Investment bonds are typically set up with multiple lives assured. When the life assured or the last life assured dies, a chargeable event arises. One of the benefits of having multiple lives assured is that it provides more flexibility and ensures the longevity of the investment.

Segmented Policies

An investment bond is structured as a series of mini-policies, known as segments. This segmentation offers more control over taxation and access to the investment. A chargeable event can occur if an individual fully surrenders the bond or some of its segments. Additionally, assigning the bond for consideration (i.e., transferring the bond to someone in exchange for something) also triggers a chargeable event.

5% Partial Withdrawals

Investors can withdraw up to 5% of the investment amount each year for up to 20 years without triggering a chargeable event. This 5% allowance is cumulative. However, if the cumulative allowance limit is exceeded, a chargeable event occurs. This is known as a partial withdrawal exceeding the tax-deferred cumulative allowance.

Timing of Chargeable Events

The timing of chargeable events is crucial for tax planning. For events such as death, full surrender of the bond or segments, and assignment for consideration, the chargeable event arises immediately. Consequently, any income tax due is payable in the tax year in which the event occurred.

In contrast, for partial withdrawals that exceed the 5% tax-deferred cumulative allowance, the chargeable event arises at the end of the policy year. For example, if a policy year ends in May and a partial withdrawal is made in January, the chargeable event will not occur until May. This means the chargeable event will be taxable in the later tax year, which can impact the individual's income tax position.

Assignments and Gifts

Many individuals may choose to assign a bond by way of a gift, which does not give rise to a chargeable event. However, it is important to ensure that such an assignment is outright and unconditional to avoid triggering a chargeable event.

Example: 5% Tax-Deferred Withdrawals

To illustrate the 5% tax-deferred withdrawal rule, consider an individual who invests £100,000 in an investment bond. They can withdraw 5% of £100,000, which is £5,000, annually for up to 20 years without incurring a chargeable event. If no withdrawals are made by year 20, the individual can take the full investment amount without triggering a chargeable event. However, it is important to note that while this amount is tax-deferred, it is not tax-free. When calculating chargeable event gains, capital withdrawals must be accounted for.

| Policy year | Ending | Annual Allowance | Accumulated Allowance |

| 1 | 2 March 2025 | £5,000 | £5,000 |

| 2 | 2 March 2026 | £5,000 | £10,000 |

| 3 | 2 March 2027 | £5,000 | £15,000 |

| 20 | 2 March 2045 | £5,000 | £100,000 |

Calculating Chargeable Event Gains

Calculating a chargeable event gain involves several key figures:

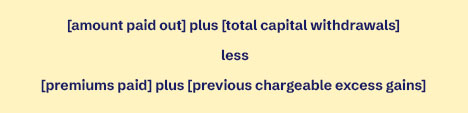

The chargeable event gain is calculated as follows:

Conclusion

Understanding chargeable event gains is essential for effective tax planning in investment bonds. By being aware of when chargeable events arise and how to calculate chargeable event gains, investors can make informed decisions that align with their financial goals and tax positions. Whether choosing an onshore or offshore bond, careful consideration of individual circumstances and long-term objectives is key to optimizing investment outcomes.